Forecasters are calling for a semiconductor market downturn in 2023 but a few bright spots will keep some suppliers buoyant.

Weeks after closing one of their best quarters in recent years, semiconductor manufacturers are confronting a different landscape with forecasters now calling for slower than expected market growth and a possible downturn in 2023. With some sectors remaining vibrant, though, chip suppliers are wary of calling an end to the upcycle they have enjoyed over the last couple of years.

As in the past, the consumer electronics and PC markets have been quick to show signs of weakening demand. Suppliers Intel and Advanced Micro Devices have pared their forecasts for the year amidst warning of a looming downturn.

Still, AMD shone brightly during the second quarter. Its revenue rose 83 percent from the year-ago quarter and 15 percent sequentially, boosted by strong demand for its server processors from cloud and enterprise customers. Demand from the data center market is expected to remain strong through the third quarter but sluggish growth in the PC segment could hurt sales, according to AMD executives.

“There are multiple dynamics that we’re looking at. In the current guidance for the full year and the second half, we continue to see strong demand in the data center, in our embedded business, as well as in the console business,” said Lisa Su, chairman and CEO of AMD. “We are being more conservative in our PC outlook. There was a bit of buildup in PC inventory, and we’ve taken that into account in the second half.”

Some other market segments are similarly constrained. Forecasters are beginning to reach the conclusion that the semiconductor industry will soon begin the next cycle of its infamous downturns. They point at efforts by manufacturers to reduce inventory, warnings of a global economic slowdown, inflationary pressures, and geopolitical tensions in many parts of the globe as combining to weaken consumer confidence and enterprise equipment demand.

“The outlook has darkened since April,” said Pierre-Olivier Gourinchas, chief economist at the International Monetary Fund, IMF. “The world may soon be teetering on the edge of a global recession, only two years after the last one. Under our baseline forecast, growth slows from last year’s 6.1 percent to 3.2 percent this year and 2.9 percent next year. This reflects stalling growth in the world’s three largest economies—the United States, China and the euro area—with important consequences for the global outlook.”

Semiconductors have become so ubiquitous in so many industries today that a global economic slowdown is bound to trigger a corresponding weakness in the electronics market. Forecasters have been updating their growth figures for the chip industry with many of them now calling for weaker results this year and negative growth in 2023.

Gartner Inc., for instance, says the market will shrink 2.5 percent in 2023 after a torrid expansion of 26.3 percent in 2021. The market research firm has also tamped down its prior growth estimate for this year, scaling it lower to 7.4 percent, from a prior forecast of 13.6 percent expansion. Demand for semiconductors have been sharply curtailed from many market segments, led by the computing and handset markets, Gartner said.

“We are already seeing weakness in semiconductor end markets, especially those exposed to consumer spending, said Richard Gordon, vice president of practice at Gartner. “Rising inflation, taxes, and interest rates, together with higher energy and fuel costs, are putting pressure on consumer disposable income. This is affecting spending on electronic products such as PCs and smartphones.”

PC sales rose strongly during the Covid-19 pandemic as workers transitioned to telecommuters and as companies aggressively encouraged employees to work remotely to curtail the likelihood of infection. As a result, PC sales increased at a double-digit rate in 2020 and 2021, according to data from IDC. Demand has since stagnated, though, and shipments are forecast to drop starting this year and extending through the next year. For the second quarter, IDC projects a 5.6 percent decrease in demand for desktops, notebooks and workstations.

“Shipments are still above pre-pandemic levels; however, growth has softened, which is an indication of the market reverting to normal seasonality,” IDC said. “While the overall market contracted due to saturation in mature markets, Asia/Pacific (excluding Japan and China) still recorded growth in the quarter as there have been several large investments for digital education in the region.”

PCs are the weakest link

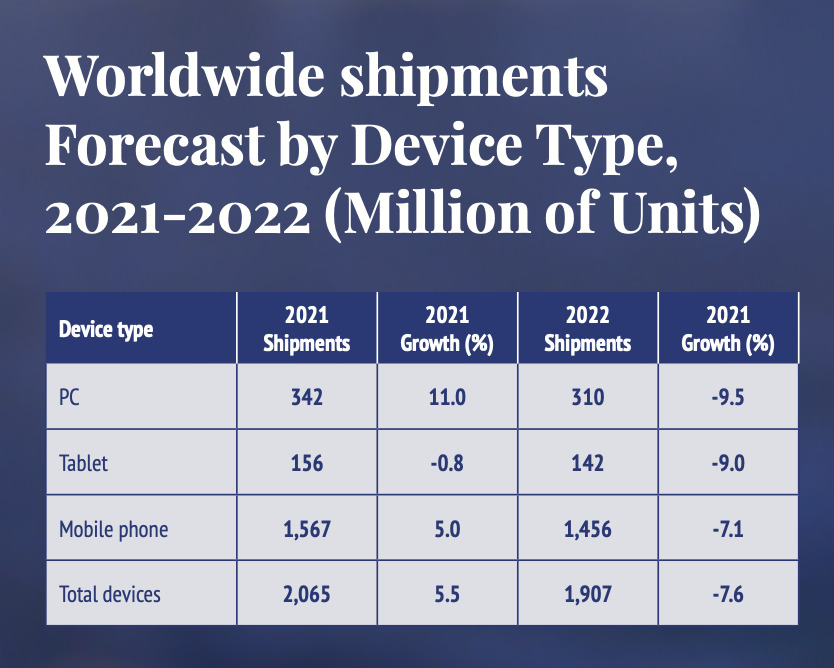

PC OEMs are amongst the largest users of semiconductors globally and a reduction in demand for computing devices will hit them hard, analysts said. After the huge increases of the last couple of years, annual PC unit shipments will drop 9.5 percent in 2022, according to Gartner. The market researcher projects shipments of 310 million units in 2022, down from 342 million last year. The consumer PC segment and the EMEA region will lead the decline, it said.

“A perfect storm of geopolitics upheaval, high inflation, currency fluctuations and supply chain disruptions have lowered business and consumer demand for devices across the world and is set to impact the PC market the hardest in 2022,” said Ranjit Atwal, an analyst at Gartner. “Consumer PC demand is on pace to decline 13.1 percent in 2022 and will plummet much faster than business PC demand, which is expected to decline 7.2 percent year over year.”

Similar challenges are being seen in the smartphone and consumer electronics markets. The adoption of 5G devices rose globally over the last several years led by strong demand from Chinese consumers. Initial forecasts called for a 47 percent jump in global unit shipments this year. However, demand in the Greater China area sank by mid-year, drowning under measures taken to curb the spread of Covid-19. This will result in a decline of 2 percent in unit shipments of smartphones in the area this year, dropping from an increase of 65 percent in 2021, according to Gartner.

“At the beginning of the year, the Greater China 5G phone market was expected to show double-digit growth,” Atwal said. “The impact of China’s zero tolerance Covid-19 policy and resulting lockdowns have dramatically reversed this trend. Large numbers of consumers stopped buying non-essential items.”

It’s not all gloomy ahead, though. Demand for electronics is expected to remain strong in the next several years ahead as companies forge ahead with efforts to digitalize their operations. Some industries are more aggressive and have made further progress in the digitalization efforts than others. Sectors such as automotive, banking and finance, high-tech, medical and services were quick to adopt electronics since the beginning of the millennium while others are just beginning to catch up. But early adopters still have ways to go, according to industry sources who argue that even developed nations like the United States have not fully tapped the promises of technology advancements.

In addition, developing economies are generations behind in the use of certain technologies and are eager to widen the adoption to improve their competitiveness. This is boosting demand for chips and technology products, which means even a slowdown caused by efforts to control rising inflation will be shortlived, according to experts. A snapback in demand for semiconductors with a few quarters is possible, they said.

Certain market segments will perform better than others over the next few months and during any market downcycle, including the one projected to start in 2023. Areas such as artificial intelligence, IoT, cloud computing, data centers, automotive, industrial and transportation are seen leaping ahead of traditional growth drivers for semiconductors like PCs, enterprise computing and smartphones. The likelihood of a long-lasting slowdown is remote, according to observers.

“Driven by the trends of digitalization and sustainability, the demand for semiconductor solutions will increase significantly in the future,” said researchers at Oxford Economics in a paper.