New report examines current methods and future trends for the thermal management of electric vehicle.

New report examines current methods and future trends for the thermal management of electric vehicle.

As the electric vehicle market grows there is increased need for effective thermal management. Keeping heat under control leads to improved charging, performance, range, longevity and safety. A new report from IDTechEx covers aspects of thermal management for electric vehicles including the batteries, motors and power electronics.

High profile battery related fires from well-known automotive manufacturers does little to instil confidence in potential consumers. With this in mind several new regulations have been proposed relating to safety aspects unique to electric vehicles. The likely outcome of this being that manufacturers will be required to halt thermal runaway at the individual cell level and warn the vehicles occupants, giving them at least five minutes to exit the vehicle once a thermal event occurs.

Several factors must be considered when designing an electric vehicle for safety, from materials used in the battery pack construction to thermal runaway prevention and early detection. Several companies are designing methods of stopping thermal runaway between cells including flame retardant encapsulants, interweaved products and phase change materials. Effectively dissipating heat from the battery module or pack to a heat sink is also important and usually carried out using a thermal interface material. This is another area where manufacturers have adopted several strategies including gap pads, fillers and conductive adhesives.

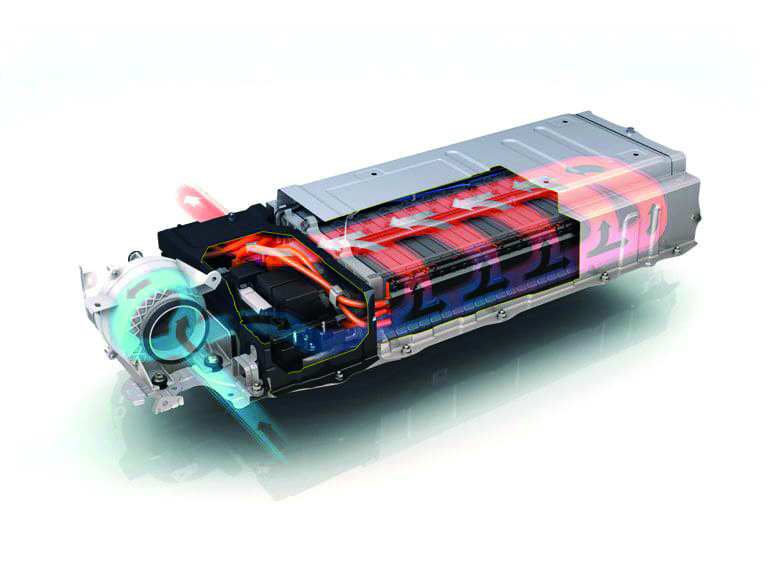

Every manufacturer has its own methodology to thermally manage their batteries with no clear consensus on the most effective design. Companies like Tesla are set on their patented water-glycol coolant lines which snake their way between the cylindrical cells in the pack, whereas Nissan and Toyota are committed to air cooling.

Active battery cooling with fluids keeps a vehicle cool in conditions where it is stationary but the batteries are in high demand (eg during fast charging). It also allows batteries to be raised to optimal temperature in cold ambient conditions. These are significant advantages but come at the expense of weight, complexity and cost.

Despite these caveats, IDTechEx has observed a market shift towards liquid or refrigerant cooling and foresee this trend continuing into the future, especially following the rise of charging with 350kW sources, with the amount of liquid or refrigerant cooled batteries exceeding 500GWh by 2030.

In addition to widely adopted technologies, other emerging alternatives include immersion cooling and phase change materials. These technologies are gaining modest traction, especially for more specialised markets like construction. The report appraises all these cooling methods in addition to the players utilising them.

The electric motor is the unifying component of an electric vehicle and more demand is being put on them regarding performance during extended use. Most manufacturers use motors containing permanent magnets. These magnets can be denatured and rendered useless above a critical temperature and also need effective thermal management.

Even motors without permanent magnets still require cooling to improve performance and reduce overheating neighbouring components. Methodologies adopted typically consist of air, oil or water-glycol cooling. Several manufacturers use the same coolant circuit for their batteries and motors. This reduces the number of components and fluids, while simultaneously allowing excess motor heat to warm the batteries or passengers in cold conditions.

In addition to batteries and motors, power electronics also have to deal with significant heat. The way wire bonds and soldering is carried out, plus the material used, impacts the performance and longevity of the power electronics. Several OEMs are shifting towards advanced substrates and even eliminating the thermal interface material altogether.

IDTechEx’s report, Thermal Management for Electric Vehicles 2020-2030, covers the above topics through extensive research including primary interviews with companies in the field. The report covers the strategies used by major OEMs, emerging technologies and market forecasts.