CarlisleIT’s director of product management, Jeff Behlendorf, discusses major developments impacting the interconnect sector

What trends are driving the interconnect sector?

What trends are driving the interconnect sector?

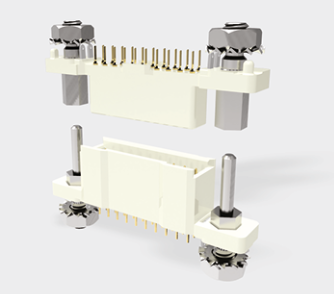

We see a focus across all markets on increased connection density and reduced weight. This can be smaller packages for connectors overall or ways to get more signals and power into a smaller space. To add to this challenge, manufacturers are also striving to reduce weight and boost performance, particularly in aerospace applications.

Interconnect manufacturers are always under pressure to get more into connectors due to growing demand for electronics within aircraft of all sizes. Couple this with the impacts of wiring on payload capacity and range and every ounce counts. Space and weight are two areas where customers consistently need our expertise and the pressure for manufacturers to create higher-functioning, smaller-form factor, multi-purpose interconnects is increasing.

The industry-wide shift to electric aircraft is also accelerating changes in the interconnect market. These aircraft require interconnects that can handle a high power—often over double the highest voltages common in current aircraft.

How are raw material costs affecting pricing and lead time?

Over the last 12 months Covid-19, pent-up market demand and producer inflation have impacted the price of copper, silver and gold. Where possible, our team is looking at alternatives like fibre optic solutions that meet cost and speed-to-market requirements and allow large amounts of data interconnect, all while achieving size and weight requirements. However, with everything trending towards electrification, there is no escape from precious metals. Materials used vary with the application so our team works with customers to identify the right solution.

How would you advise a purchaser to engage with a new or alternative connector supplier?

Building a high-performing interconnect system is a complex undertaking but is instrumental to the overall success of a project. When engaging with a connector supplier, purchasing professionals should consider three key strategies to ensure success: know your requirements; focus on quality and on-time delivery; and select a partner who knows the industry. After identifying a project’s requirements, buyers will be prepared to select a partner with the required components and capabilities. Identifying a partner with a wide product range helps organisations quickly build and test by using a complete portfolio of certified and proven designs and materials. Suppliers must have the capability to deliver existing or custom solutions on time and at a high quality. They should be well-versed in the customer’s industry and have a demonstrated ability to innovate and deliver at scale. In addition, the partner must understand certification requirements and help achieve them.

What are today’s fastest-growing markets for connectors?

Increasing automation and electrification of vehicles and

aircraft present a significant opportunity for interconnect innovation. Both require connectors that push power without adding pounds, leading manufacturers to explore new materials, metals and layering strategies to meet evolving size, weight and power requirements.

Space applications are also growing due to the deployment of more rockets, satellites and probes. Currently, there are nearly 6,000 satellites in Earth’s orbit and projections show that nearly 50,000 more will be added over the next two years. This means space-rated hardware needs are ramping up dramatically, driving the space industry to scale significantly to get these satellites in orbit and keep them in service.

www.carlisleit.com