In this article, Supplyframe highlights new analysis suggesting that commodity shortages and cost increases will persist into the first half of 2023.

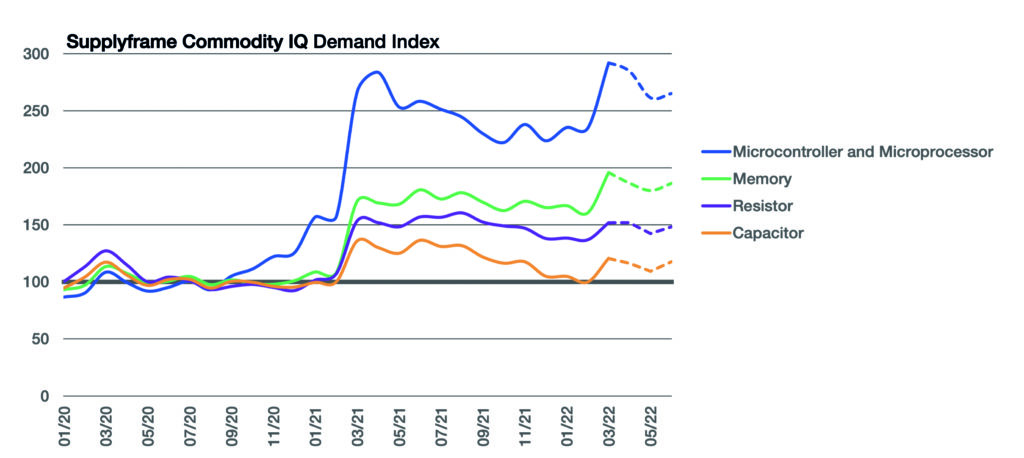

New data from Supplyframe paints a grim picture of current and expected conditions in the electronics supply chain, where commodity supply tightness and cost inflation are impacting most inputs across categories. Continuing category challenges at the beginning of this quarter suggest there will only be pockets of relief through the remainder of 2022 and into 2023 for many commodities.

This includes shortages of resin feedstocks and additives, increasing costs for fuels and metals and challenges related to the affordability and availability of labor and freight capacity.

Supplyframe CEO and founder, Steve Flagg, said: “Geopolitical uncertainty and wide-ranging impacts from the Russian invasion of Ukraine, persistent global inflation and recurring Covid-19 outbreaks continue to wreak havoc and test beleaguered industry supply chains.”

The second quarter began with nearly half of all Supplyframe Commodity IQ dimensions worsening, while the number of pricing indicators in the red grew 16 per cent quarter-on-quarter. Things are not expected to improve as the quarter progresses. Commodity IQ expects 85 per cent of all pricing dimensions to increase and 83 per cent of all lead time dimensions to extend this quarter.

Supplyframe chief marketing officer and SaaS sales leader, Richard Barnett, added: “Sustained Covid-19 eruptions in two-thirds of Chinese provinces and elsewhere in Asia are prompting government-mandated shutdowns and strict containment protocols—creating further labor limitations, straining supply and introducing new supply chain disruptions.”

The electronics supply chain can expect growing challenges into next year. Through the first quarter of 2023, more than 70 per cent of lead times are forecast to increase. During that time frame, analog, complex semiconductor (ASICs, MCUs, MPUs, PLDs), flash memory, non-ceramic capacitor, resistor and standard logic devices are forecast to rise in price with very limited exceptions. Most of the same devices will also remain at or exceed already elevated lead times.

One category that remains particularly stubborn and hostile is the active components market. From analog power to standard logic to ASICs and sensors, this space will be swimming in a sea of red indicators for the next four quarters. This is happening as strong demand continues, production is at capacity, there are extended lead times and rising prices plague most devices.

Passive components are not as constrained as active ones. However, like active components, passive commodities also suffer from raw material challenges and labor shortages.

suuplyframe.com