Distributors Deliver Back-to-Back 20% Growth Years

Top Americas distributors deliver crucial value to distressed electronics components supply chain and achieve revenue jump of 21.9% in historically challenging year.

Every day presents a new challenge for distributors as they strive to deliver outstanding support to their customers and partners up and down the supply chain. Gauging by the revenue growth achieved over the past two years it appears that distributors are delivering the vital support and services that are in high demand. Delivering the support customers needed was not easy in 2022 as lead times stretched out to historic levels. Procurement teams all scrambled to secure components critical for their businesses and distributors became essential partners. The proof of the benefits delivered by distribution was highlighted over the past two years as industries and companies that did not engage with distribution experienced painful outcomes as they had to shut down production lines or redesign products for lack of components. The systems and processes that have been refined by distributors over the years formed a strong backbone for the industry as the growing challenges seemed to have no end in sight. As always, industry leaders are identifying lessons learned in order to develop solutions that will be essential for tomorrow’s challenges.

It seems that participants in the electronic components supply chain are playing whack-a-mole. The minute one issue is resolved two more pop up that must be addressed. It’s enough to cause whiplash! While lead time issues have abated as the industry entered 2023, new challenges have taken their place as inflation, rising costs, and banking concerns come to the fore. However, in the midst of a chaotic and ever-changing world, distributors were well positioned to deliver stable support across the supply chain. In interviews with industry executives the word “resilience” was used to describe the performance of distributors. Indeed, the industry has not only survived but thrived in many ways. Delivering Americas revenue growth of 21.4% and 20% in sequential years is an amazing achievement. As described here, there will be no end to challenges moving forward. The good news is that supply chain participants can turn to their distribution partners for strength and stability in a highly dynamic world.

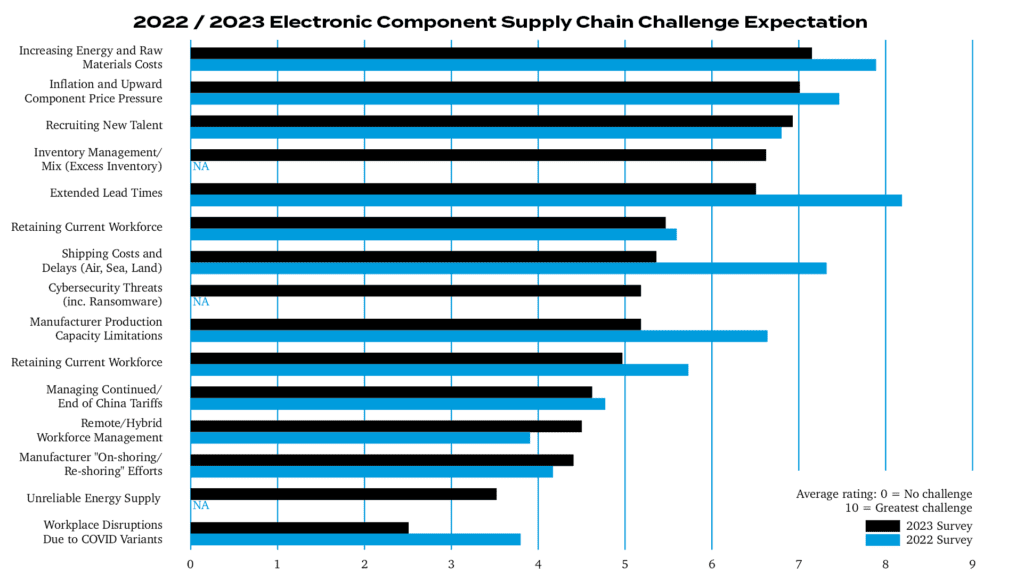

Interviews with experienced distribution executives yields important understanding regarding major issues confronting authorized electronics components supply chain participants. As part of the survey to identify the “Top 50 Americas Authorized Distributors,” executives were asked to rate the level of severity they anticipate for various supply chain challenges. The results for 2023 are compared to the responses for 2022. The good news is that almost every category saw a reduction in the level of anticipated challenge. Increasing costs, inflation, recruiting new talent and inventory management were identified as the areas of greatest concern. The results of the survey are shown below and align with topics addressed in interviews with these leading industry executives.

Inventory Overhang Solution?

Transparency / Visibility / Collaboration

As distributors manage through the inevitable market downturn following a peak in a cyclical industry, the key question that emerges is, “What can electronic components supply chain players do to improve management of inventory overhang?” John Drabik, President, TTI Americas, provided a concise summary of inventory history, “We went from Just in Time to Just in Case to Just too Much.” The solution to inventory challenges was fairly unanimous among executives as stated by Dayna Badhorn, Regional President, Americas at Avnet, “Transparency between all stakeholders is key. If supply chain providers understand the true need of the customer, it allows for easier adjustment of inventories amongst many players. It allows for customers that still may be waiting for inventory to receive what they need, while alleviating the over inventory for others.”

The solution sounds simple enough but the key challenge in achieving the needed visibility in the industry was explained by Chris Beeson, President Electronics & Global Strategic Suppliers for RS Group, “First you have to have willing participants in all segments of the equation. And maybe at times it was more of a supplier of voice and not in conjunction with the distributor voice and/or customer voice. I think the last two years have demonstrated this need. We have an opportunity to get much better. Look at even broad industries like automotive which have all types of capabilities and sophistication. It’s a much more collaborative type of approach. Maybe this current cycle is painful enough for all of us so that we’ve recognized the fact that it’s time to energize some solutions into the equation.”

Chris Wadsworth, VP, OEM Electronics at Carlton-Bates, takes aim specifically at lead times in identifying the culprit for excess inventory, “The biggest area of opportunity in my mind is a transparent and active engagement between distribution companies and their manufacturer partners on the accuracy and reality of current lead times. We really need to close the gap on published versus real lead times and actively work on balancing the on hand and on order quantities throughout the supply chain.”

Market intelligence was highlighted by multiple executives as a necessary contributor to improving lead-time management. Adam Osmancevic, SVP Global Supplier Development, RS Group, expressed his view that, “We need more use of market intelligence and analytics, cloud and edge computing, and upgrading implementation of full automation in the facilities. Then, potentially upgrade your asset management team for today’s environment.

You really need subject matter experts to be in your asset management team and not just number crunchers. You need people who actually know the industry and know the trends.” Driving the point home regarding the benefit of actionable intelligence, Lew LaFornara, Senior VP Product and Supplier Marketing, TTI Americas, argues, “It’s lead times. They drive so much of everything we do. We all have tons of data. But it’s just tons of data. The challenge is how to get that down to something more meaningful and actionable.” David Loftus, CEO ECIA, highlights a critical solution to developing actionable information, “There are better and better machine learning algorithms that can analyze current market trends against previous patterns. While this cycle is a bit unprecedented, we do have a lot of historical data in the industry that can be mined to be able to better inform the present and the future.”

Finally, Loftus points to one essential area of improvement needed by the industry, “I think first and foremost is we shouldn’t hold on to NCNR (Non-cancelable/Non-returnable) requirements too deeply into the cycle, especially past inflection points. I think that while the current cycle is reasonably unprecedented, a lot of manufacturers are sort of stuck on both ends because they’ve got take or pay agreements with fab partners and they put NCNR requirements on their distributors and their direct customers that then get passed through distributors to their end customers. When you have that amount of over-ordering that takes place on the part of the end customers and you hold those NCNR orders too far into the down cycle it is going to exacerbate the inventory overhang.”

Supply Chain Breakthroughs

Microsoft Corporation recently received Gartner’s “2023 Power of the Profession Supply Chain Award” for its submission “Real Time Visibility Enabling a Sentient Supply Chain.” As the pandemic’s effects on supply and demand waned in 2022, changing market conditions required Microsoft’s Devices Supply Chain team (DSC) to enable a quick pivot from a supply-constrained environment to a fully order-driven model, thereby avoiding significant inventory risks. Microsoft wanted to develop a sentient supply chain that was “all-sensing and monitoring,” predictive and able to consistently optimize itself in real time. This meant building end-to-end (E2E) visibility from tracking every raw material to finished-goods sales, returns and repair operations. The results of this transformation included $550 million saved in inventory risk avoidance, an Azure-driven platform that captures more than 50 million supply chain data points per day and a suite

of self-serve analytics that converts real time signals into actionable intelligence.

In interviews for this report executives were asked, “What supply chain breakthroughs do you believe the electronics component industry has achieved recently?” The responses revealed that not all solutions are based on a specific technology. Systems level solutions can deliver powerful benefits. Powell Electronics CEO, Ernie Schilling, described the “Powell Process” for supply chain integrity, security, and savings. He noted that this solution is much simpler and is already built into Powell’s world class SAP ERP system. He shared six key dimensions of this system that range from empowering “distribution to consult and eliminate all proprietary, sole source devices from the bill of material” to “creation of a task force of a very few elite engineers capable of second sourcing.” Emphasizing the need for system level solutions Ernie declared, “I believe in AI. I believe in technology. But I don’t believe in a magical algorithm, measuring the rain gauges in Taiwan or the electricity in Singapore to predict the manufacturability of products.”

RS Group’s Adam Osmancevic pointed to initiatives promoting sustainable practices and products. “We are actively pursuing major “green” initiatives. Our warehouse in Bad Hersfeld, Germany, is powered in part by a 6,000m² solar array which generates 750kW of green photovoltaic electricity and 22% of the site’s annual electricity requirement. We’re also introducing a sustainable range of products across not only industrial products, but also electronic products.” He also sees advancements in inventory management software. He states that, “those who take more advantage of that will be better suited to drive these recent breakthroughs in the supply chain that we’re seeing.”

Chris Wadsworth points out that “simple” solutions can be powerful. He explains that “another breakthrough example that is not as futuristic but is more simple is that customers are opening up specifications that had been locked for decades on older designs. They are opening up their engineering resources to design in newer technology that is much more readily available. Hard to get components are often not produced when demand for newer, more profitable products is hot. Many manufactures either obsoleted product or pushed out lead times exponentially and as a result customers have been forced to allocate engineering energy to changes which have improved many supply chains around the world.”

In the context of discussing supply chain breakthroughs executives were asked about the potential of ECIA’s “Paperless Certificate of Compliance Initiative” to deliver breakthrough results for the industry. Mike Slater, Digi-Key Electronics’ Vice President of Global Business Development, touted “ECIA’s “Paperless Certificate of Compliance Initiative” as a great example of how we need to digitize in areas of the business to create a frictionless digital experience. This will both accelerate the entire process and standardize transactions so that as an industry we can eliminate waste.” Chris Wadsworth elaborated on ECIA’s CoC initiative, “I do believe the efforts in the pilot between ADI and Digi-Key are a great example of working to digitize and help automate a manual process and free up resources. A great example of working lean methodology to solve an opportunity to use technology instead of muscle and paper! Such an example opens up other ideas to streamline other manual processes we all deal with every day and just accept. With any new process the commitment of IT resources must come into play and as digitizing continues to evolve in all of our member companies, the ability to partner and execute in these technological advances will become more accepted and implemented. A common language and process must also be agreed upon for our industry so that each company does not have to reinvent the process for themselves but can leverage the work of ECIA partnerships between reps, distributors, and manufacturers. This is a perfect example of that three-legged ecosystem at work.”

David Loftus pointed to another key benefit of this initiative, “It can also translate hopefully into a reduction of a lot of the paper that’s sent with high reliability items for space applications, Mil/Aero, and other areas where the customer’s customer is demanding that they have total sourcing documentation. To be able to put that into electronic format just makes everybody more efficient and more accurate.” Ernie Schilling looks to the future benefits, “This will inspire far more accuracy and efficiency in our systems and in our customers’ systems. It is core to all future supply chain automations. Inspiring our major customers to adopt these as the standard for internal and ISO9000xxx quality standards is the next step.”

ESG – ECIA Supports Growth

While not all sectors of the industry are engaged in or supportive of ESG, there is an opportunity for ECIA’s GIPC group to form a committee to assist the industry in implementing this initiative. Executives were asked about their opinion regarding the support ECIA could provide the industry. Chris Wadsworth was very positive in his opinion.

“I believe the industry can work together to define the “hows” and the “whats” in a common platform or format that helps both educate the industry on what ESG means and what a comprehensive EGS program entails. Longer term, a critical element will be to establish a common data platform to record product attributes similar to past RoHS and REACH initiatives regarding the component sustainability footprint.” Ernie Schilling paints his vision of the potential of a cooperative initiative. “A cumulative industry solution, inspired by organizations like the ECIA is the best way to go. The cumulative resources of multiple companies, sharing and expressing data in a like manner, consumable and easily expressed is key to gaining momentum. Organizational templates help pull in all business sizes and knowledge resources. I am much more in favor of these templates than I am paying 3rd party auditors. Apply those audit monies toward real change and solutions. ESG must be voluntary expressions of each company’s culture that serves to differentiate them in the community, investment market and employment market. Based on individual behavior, businesses, investors, and people will seek out the very best among us.”

Andrea Barrett is VP Social Responsibility and Sustainability at RS Group. She has developed valuable resources that are available to the industry on their website. She highlights her view on the needed focus of a group effort. “Cross collaboration is key to progressing ESG goals across all topics. The key thing is understanding the most material issues for the industry and then picking 3-5 issues that the committee will focus on and drive improvements. A suggestion could be:

E

Sustainable product improvements and standards, greener packaging and logistics, e-waste, and recycling & circularity

S

Gender and ethnic diversity of the industry and leadership communities; responsible procurement practices in the supply chain

G

Traceability, conflict minerals

David Loftus sees very practical benefits to a common effort around ESG. “I think there is a need to identify what the mainstream is going to be going forward and try to arrive at a common format for when customers make inquiries and requests for information. Hopefully, this will eliminate the need to answer a gazillion one-off inquiries from customers. The need is to develop some standards for people to put that information up on their websites for self-service data on the web. When you get into all these one-off requests and when there’s not a particular accepted format, it creates tremendous amounts of manual effort on the part of sales support and operations organizations with suppliers and with distributors.”

Again, not everybody is supportive of ESG initiatives. Acknowledging this, Chris Beeson points to a neutral role ECIA can play. “There are some smaller distributors that have said, ‘I don’t want any part of that.’ I don’t think our role is to dictate. I think our role is to educate. Talk about pros and cons and just show others the industry movement that’s taking place. If one chooses to participate or not that’s an individual organization’s discretion to be able to do that.”

Since the earliest days of ESG various ratings organizations have been formed to provide ratings for company compliance/support of ESG principles. The question arises regarding the possible need for ratings organizations specifically focused

on the electronics components supply chain. Does one size fit all or is there a need for specialization? There were split opinions on this topic. Some saw the benefit of specialization, but the strongest arguments were opposed to the development of a specialized ratings organization for our industry.

Barrett of RS Group expressed her view very effectively. “I would strongly discourage establishing ratings agencies for individual sectors. Sustainability reporting is already out of control across agencies, companies and sectors and we desperately need global convergence and standardization. Otherwise, more time is spent on reporting than action. That’s not to say that there shouldn’t be industry groups that provide support, forums, and standards for the industry. A bit like the responsible minerals alliance or the sustainable apparel coalition. These groups are excellent at developing approaches to tackle specific industry issues, establishing best practice standards and driving ACTION and PROGRESS on key areas.”

Ernie Schilling expressed a strong opinion regarding the appropriate focus. “All of us can cite examples of companies that have high ratings on 3rd party auditing companies, ranked best in the world for some ESG attribute, that are also on the front page of child labor, chemical spills, or 100-million-dollar lawsuits, for which they accept no blame. Instead of paying for these 3rd party entities to sanction and publish our evolution in ESG, it would be better to apply those energies and funds toward real change. Spend the monies on significant internal actions and programs, not the grandstanding and marketing of modest gains. Hopefully this way the real actions will last longer than the attention span of the media.”

Within the ESG scope, customers are now asking for the “carbon footprint” at the component level. The question now comes about what approaches can be used to address this challenge? SEMI recently announced a Semiconductor Climate Consortium. Executives expressed a wide range of opinions on this topic. Dayna Badhorn stated that, “working on a template for suppliers to capture compliance information for TSCA will be a huge step. Additionally, we have customers asking what the carbon footprint is of their products. This is our customers’ Scope 3 emissions. There isn’t an industry standard model to perform the calculation and lack of available data that will provide an accurate carbon accounting is an issue. It would be fantastic if ECIA could help us get to a common model for the industry to provide this information to customers. They might be able to help us build a usable model at the category level using averages, or revenue, etc.”

Andrea Barrett offers very helpful information on the direction of industry demands and legislation regarding ESG and carbon footprints along with a possible path forward that is reasonable in scope. “The existing gold standard to understand total carbon footprint is to conduct a lifecycle assessment (LCA) for each component or product. This helps companies to understand the carbon footprint and other environmental impacts of their products at all stages of the lifecycle – raw materials, manufacture and production, distribution, in-use, after-life processing – and includes all the elements upstream and downstream from them. It can be declared in an Environmental Product Declaration and shared with their customers / distributors. The future direction is that carbon footprint of products will be required on product labels and marketing assets. We are still a little way off this, but customer expectation is rising, and legislation is emerging, so companies should try to get ahead of the game now to meet their stakeholder needs, differentiate their brands and ensure they’re fit for the future. For example, EU Legislation on sustainable product eco-design includes a digital product passport and carbon footprint is one of the attributes, along with other key elements like percentage of recycled content or recyclability.

“However, LCA is time and cost intensive e.g., it can cost £50k and take 3-4 months for a single product, so full-scale adoption is challenging. The likes of Schneider and Siemens etc. are already making this a core part of their product development strategies. The more that can be shared on this between companies and sectors the more it will lead to full-scale adoption, clearer insights into product carbon footprints and effective carbon reduction strategies. There are other algorithm-type services out there that can also calculate carbon footprints by plugging in assumption data on the raw materials, distribution methods and in-use variations.”

David Loftus steers a moderate course and cautions against aggressive or extreme approaches to carbon footprint efforts. “I’d say ECIA’s position is to evolve with a mainstream and not service extreme proposals. Hopefully we can come to a good agreement about what information is required, should be provided and is helpful really to society in being able to demonstrate that companies are moving in a positive direction in each of these areas. It’s not to diminish the value of any of the initiatives under ESG in general. I feel that there is a reasonably positive direction that if done in a practical fashion we can engage and try to start servicing these kinds of requests. I think expensive and overwhelming approaches are not an effective use of limited bandwidth on the part of most manufacturers and the channel. I think in the end, common sense and practicality have to play a major part in what we do.” Similarly, Chris Wadsworth expresses his view, “I feel like the industry can bring distribution and manufacturers together to develop a common method to record and communicate attributes like carbon footprint. I like the “keep it simple” method and add to the manufacturers part number attribute taxonomy for feeding electronic servicing methods of data communication. One variable is communicating the standard method to define the carbon footprint as the entire supply chain influences that measurement.”

It’s a small – and fragmented – world after all!

Geopolitical challenges, especially between the U.S. and China, have been amplified during the past year. It seems that we are going down a path that will take us from a global electronics economy to a fragmented/balkanized world where electronics supply chains and production will be increasingly localized. Executives were asked if they agree with this assessment and given the opportunity to provide their perspective on global concerns.

Dayna Badhorn shared her view that, “This industry has been cyclical in nature on many things. We started with localized inventory and then went to centralized warehousing. Now we see the trend move back to inventory close to the customer. Some of this was caused by supply chain challenges and not just political challenges. We see more growth in countries such as Vietnam, Malaysia and Mexico which demonstrates a global economy but shifting by country a bit. Customers have created Made for China strategies to address geopolitical challenges. I believe distribution has many opportunities for growth with these changes. It makes the supply chain work, particularly around visibility and agility, even more important than ever before.”

Presenting his view on the impact of recent disruptions Chris Wadsworth explained, “The last three years of supply chain disruptions have made it abundantly clear that relying on China is a liability that is less in a company’s control and subject to unexpected and sometimes politically motivated disruption. I feel like companies will continue to drive a much more stable supply chain that provides options and more control. Those options will promote localized sources of supply. The cost of the product has a new definition especially the opportunity cost to not have product when needed. Technology IP will also continue to drive and influence localized behaviors.”

In their discussion, Beeson and Osmancevic pointed to recent government actions and the battle facing the industry. “Moving manufacturing out of China is not a quick process. The ultimate cost of deglobalization will be determined by the rise in geopolitical unrest. The CHIPS Act is one response to these topics. Is that the right thing to do? A wrong thing to do? We’re going to see more of that type of practice. The CHIPS act is one thing. But it’s still not enough money. $52 billion sounds like a lot, but in the grand scheme of things… You’re facing a technological war which is far greater than any of the other wars that are being fought out there. This is a major one. If the US loses, there are damaging circumstances that will end up happening. So, this is a war that the US must win.”

David Loftus reflected on the implications of how major world powers are interacting. “There’s no doubt that we’re moving away from the concept of the unified global economy. I certainly hope that some of these extreme political views are brought back toward the mainstream again. There are shipment restrictions that are going on because there are some bad players in the world that are threatening other governments, other economies, and other people that just really have no place in the modern world. In some cases, governments use very blunt instruments to affect change when hopefully

there would be better opportunity for diplomacy and little more pragmatic economic sanctions without going to outright bans that could exacerbate the geopolitical situations. When you’re talking about trying to cut China off from vital technology for their economy, the least they’re going to do is create a tremendous competitive force to try to be self-sustaining. I wish that governments could be a little more perceptive and try to utilize other methods of sending early signals when we see bad actors on the political stage.”

There are pros and cons for distributors in the current global environment. Wadsworth sees an upside as he explains that, “our company’s biggest growth opportunity will be gaining manufacturing back stateside as our diversity in customer segments and verticals benefits us both on the infrastructure build out as well as the US sourced component demand that will be returning to support US machinery builders. We are excited to see many companies bringing production back onshore.” On the other hand, Loftus adds a word of caution and emphasizes the importance of the authorized channel. “Unfortunately, it also brings opportunity for brokers, counterfeiters, and others. I think that there’s certainly been a realization within the past couple of years that the authorized channel needs to play a much bigger part in many companies’ supply chains. Those that had in many ways overlooked that and really forced themselves into unnatural supply chain situations that tried to bypass the channel. I think that the geopolitical situation and the incredibly unprecedented cycle that we’ve just gone through with the pandemic reinforces the tremendous value that the authorized channel plays in being able to cushion some of these uncertainties and to be able to provide a good backstop to people’s procurement processes.”

The New Frontier of Artificial Intelligence

It seems that generative AI is what everybody is talking about now, especially with ChatGPT capturing headlines and imaginations (good and bad) in recent months. (Let’s hope we can avoid the “Terminator” scenario!) Of course, AI and Machine Learning are not new and various tools and programs have been adopted in industrial applications already. Executives were asked if they see any developments in the adoption and application of AI in the distribution world in the coming year that could unlock significant supply chain improvements. Could we see a major increase in the use of AI tools in the supply chain in the near term?

In discussing AI, Chris Beeson noted that, “AI for many of us is not a new concept. But the development has now occurred where you’re starting to see producible results. You’re starting to see the applications applied to your business practice and that’s occurring in inventory management. It’s occurring within web development and product development. For some it’s a brand new topic and for others that have been on the journey, they’re actually starting to reap the rewards of the investments that have been put in place over the last couple of years.” Adam Osmancevic added, “There was a recent study by Accenture where they surveyed 850 global executives and found that nearly half of them, around 45%, planned to commit at least 1/5th of their AI budgets to meeting regulatory requirements by 2024. You’re going to see more and more companies in our industry move to AI and supply chain because it basically eliminates the need for planners to perform the same calculations, taking the guesswork out of planning and buying.”

Mike Slater was conservative in his view. “I am not sure we will see a major increase in use in the near term. But I believe that companies that invest in that area and figure out the best use and benefits will make greater strides. As with many technology shifts, it will take time and resources to put the strategy and tools in place to make the best use of that technology.” Ernie Schilling took a practical position on the adoption of AI. “The key will be identifying the leading indicators, barometers, and litmus tests to launch real orders. We have all gained from ERP systems, automation and we have all suffered based on the variable given the most weight. Using AI to calculate sales & marketing’s sales forecast BS factor, might be our very best application.”

Two experiences in the use of AI in their companies came from Chris Wadsworth and Lew LaFornara. Wadsworth shared, “Our company is committed and investing more than ever in our digital transformation. Helping drive better decisions, faster for our customers and for our internal teams, will continue to be the winning move. AI integrated with quality leverageable data makes this engine run and this will continue to be a focus in all companies. The future will be much different in how we interact, exchange information, and communicate with future decision makers in the companies we all do business with, and we must all realize and invest in this reality.” Fornara presented the process and prospect of AI.

“We’re using AI here, and we’re still learning how to take all the data that we have between the family of companies and use that in a way that’s effective right? Our analytics team is constantly looking at ways to use AI and machine learning too. I think that’s what the industry is going to do. But I think over time we’re going to get better at that. It’s probably not something in the short term that we’ll solve. But I do think over time AI will play a critical role in helping us improve the visibility and the resiliency of the supply chain.”

David Loftus views the status of AI adoption as being in the earliest stages. “As far as generative AI, I’ve done some experiments with ChatGPT. While I think it’s a really novel idea, it certainly has a long way to go to be a highly accurate tool. It can certainly provide some interesting framework for people to develop marketing material and make it a little easier. But it must be very closely checked. As far as its application in the distribution world and in supply chain overall it goes back to my point about progressive companies using artificial intelligence and machine learning today in analyzing ordering patterns against historical cycles. I think that we’re just learning to crawl. We’re not even toddlers yet in the evolution of how AI and machine learning can be used in trying to make the supply chain more efficient, whether it’s manufacturing or whether it’s in distribution.”

Blackouts, brownouts, and skyrocketing energy costs raise concerns that reliable energy may not be reliable in the future. This presents the question about what steps can be taken to mitigate the impact on the supply chain. Mike Slater presents a fundamental view on addressing energy risks. “Having a multifaceted and balanced approach to any problem would mitigate some of the risk and impacts to the supply chain. Having a plan that includes risk mitigation and disaster recovery and then consistently monitoring areas that may impact your plan are key to staying ahead of this.” Dayna Badhorn discusses the lessons we should have learned in meeting this challenge. “As an industry, we have seen these disasters across many years. Whether they are geopolitical disruptions, natural disasters – fires, earthquakes, etc., logistic disruptions in ports, or material shortages – we will always have risks affecting our industry. Steps as I mentioned prior are with transparency of information and a solid supply chain in place. We need to not forget the changes we made to supply chains this past year for visibility and agility, to not have history repeat itself again. If customers are investing in getting the right supply chain in place now, it should alleviate some of the disruption that has happened over the past few years.

Although no supply chain was perfect, we did have customers with minimal impact due to a solid supply chain in place prior to the latest shortages.”

Wadsworth looks to the opportunities to develop creative energy solutions. “I believe one of the largest opportunities in our industry is the creative solutions and advancement opportunities to supplement the grid through alternative energy methods and other grid hardening initiatives. We will not get to the 2030 electrification vision without reliable power sources. Amazing advancements will come alive in the next few years. The math just does not work with the current supply and future expected demand across the world. We will all need to be involved in development of the next generation solutions which is a very fun place to be working and investing in the demand generation efforts as industry partners.” Building on this positive perspective, Osmancevic shares a compelling study, “Deloitte recently had an article that said, ‘Renewable energy can be used throughout the supply chain to decrease long term cost, mitigate risk, support new revenue, enhance brand value, and improve employee engagement as tech and regulations mature. Companies should be reevaluating their energy procurement strategy to take advantage of those benefits.’”

David Loftus sees market dynamics as the key to making choices that will secure a stable future for energy supply. “As far as the ominous reports about electrical infrastructure and other infrastructure I think that the free-market economy will take care of itself. Ultimately, if people start demanding more services and those services don’t keep up, there will be penalties paid – the first in the way of just lost revenue opportunity. A free-market economy is very efficient usually at solving those gaps. But if not, democracy hopefully has an opportunity to work and usually works at a slower pace. But if governments are not able to keep up with those types of infrastructure demands, then those governments eventually change. That’s the beauty of a democracy. We’re not living in Soviet times where the government said what you’re going to get, and you stand in bread lines and grin and bear it.”

Finding and motivating the talent that will create the future

Discussions around the significant changes accelerated by the COVID pandemic and their impact on employee / labor issues at distributors generated the most expansive and engaging opinions. It is tragic that so much of what was shared will have to be left on the cutting room floor due to space constraints. There may be a future opportunity to share more of these valuable insights in another ECIA report.

Chris Wadsworth describes the challenges and benefits that have emerged from managing through the pandemic. The struggle to attract operational employees that are critical to our distribution network continues and labor is at an absolute premium. This fact is driving the most significant change we have seen which is higher levels of automation in our warehouses and assembly centers which actually equally benefits many of our manufacturing partners supporting those technologies. Wage inflation has been significant and will not likely return to post COVID levels.”

From the upside Wadsworth shares that, “using electronic tools for meetings (IE, Teams or Zoom) has been a game changer in terms of efficiency and the ability to have a higher number of customer and supplier touches in a given period. Our sales teams are able to leverage these same technologies to

have more frequent sales and support calls with customers and can much more easily engage subject matter experts in those meetings without having to fly across the county. Decisions are being made much quicker and much more economically.”

Turning to a topic that is not necessarily related to the pandemic, Wadsworth looks at the challenge of, “attracting younger people into our industry. Despite the aspirational effort, we continue to see only slight increases in the younger generations in our companies today. This is a significant opportunity for many people early in their careers. This is also a risk to our companies as much of the knowledge base and experience will retire over the next decade. Companies that win the war on talent will win the competitive war in the marketplace. Our industry is at a crossroads as many of our team members age out toward retirement. This will also advance a more digital workplace and customer interface that many companies are excelling in today.”

Wadsworth shares the highly valuable role ECIA and its partners are playing in addressing the challenge of recruiting young talent to the industry. “I believe the industry is trying new approaches; however, the improvement is a slow but steady effort. SPARK has been a successful effort that ECIA through our EDS organization is helping develop and educate our up-and-coming employees early in their career on the broader opportunities in our ecosystem with reps, distributors, and manufacturers. Another important effort has been in the ECIA partnership with FIRST promoting STEM in our schools all around the country. We need the next level of engineers and technology coming into our industry for both our customers but also for our industry to replace the aging work force and continue to lead the world in innovation and cutting-edge technologies and stay on top of the world. ECIA has also sponsored the PACE set of training modules to help new employees in our industry come up to speed in understanding how the entire network operates and improve their learning curve and add value sooner in their careers.”

Mike Slater states, “I do not think distributors are unique in the changes accelerated by the pandemic. Many people are looking at things much differently than they were three years ago. Success relies on the chance to grow and the ability to constantly adapt to changes and opportunities. Growth and adaptivity are easiest to obtain when we have a strong connection to our peers, culture, and company. This is something we were doing long before the pandemic and put effort into

every day.” Badhorn provides a specific example of building on a strong company culture. “At Avnet we were a hybrid work force before the pandemic happened. We are back to that now. Simply put, we care about our people, our culture and our company’s performance. It is critical that we continue to deliver superior customer service, and giving employees access to the leadership, resources, and collaborative office environment is essential to this goal. Having people in the office helps with culture and collaboration. We see our customers coming back to work as well allowing us to engage with them as we had in the past. There have been some layoffs in the tech sector – the competitiveness for talent in the market has come down some with this phenomenon. We have not made a large amount of change in how we recruit. We want to be transparent to our hires and they must want to be part of our culture. We have a strong Employee Value Proposition, and we continue to enhance it in many ways.”

Defining Resilience

Major challenges help identify both strengths and weaknesses. Reflecting on the most recent history of the electronics component distribution industry gives us the opportunity to see what has been learned. In discussing the strengths that have been revealed, many executives gravitated to the defining word “Resilience.” John Drabik emphasized that, “we are a very resilient industry. There’s nothing we can’t really overcome. Look at all the things that were thrown at this industry, and it came out not only doing well, it came out doing extremely well. I think we’ve learned that the highs are still really good. The lows feel really bad. But we can get through both sides of the cycle, right? I wish I could tell you that we are going to stop these cycles. I don’t believe that’s the case. My fear is the amplitude gets higher and the frequency increases.” Chris Wadsworth echoes this sentiment. “The resilience of our people and the ability to learn to manage through change. Supply chain issues changed how both our sales and operations team focused on keeping our customers up and running. Change was at an all-time high and our people were able to adapt and work on the process changes necessary to meet both company and customer demands. I was very proud of how our teams across our industry stepped up and improved during the course of these many challenges and helping our customers survive and excel.” To drive the point home once more, Schilling stated, “The resilience of the US worker, the creativity of management, and the IT infrastructure all passed the apocalypse test.”

Chris Beeson expressed his view that, “I think the last couple of years have been an indication of our speed of execution, flexibility of an organization, and how quickly one can pivot into a new environment. I believe some companies were really comfortable with that and there were other companies where maybe their methodology was somewhat narrow in scope. As a result, they had greater struggles in adapting to a new environment.

We all hear conversations about digital and the voice of the customer and how they want to be served. I think all those topics have been accelerated.”

Mike Slater recognized both the strengths and areas needed for improvement in the industry. “The electronics industry continues to be a cyclical industry. In some areas as an industry, we have made improvements to help smooth out these cycles, but in other areas we still have work to do. As an industry, we need to work together to continue to look at digital, data driven ways to have the full visibility needed to make quick adjustments and decisions. The long-term outlook for our industry is very strong with many people forecasting above average growth for the next 10 years. This makes for a very exciting industry, but also will bring challenges with supply that will need to be addressed.”

Executives had additional areas of concern that they expressed. Loftus looked to the need for improved partnerships. “Certainly, I think that there needs to be much closer partnerships between all major industries and our industry to be able to project growth and plan ahead for major CapEx. We need to make sure our manufacturing facilities keep up. At the same time, when you take the safety mechanisms out of the supply chain, namely in the way of distribution and holding more of your own in internal inventory, then you’re going to end up paying the price in these inflection points, especially as we are going forward with new bleeding edge fabs costing in excess of $10 billion, sometimes up to $20 billion and more, for these new super fabs. Semiconductor companies and foundries are going to be even more careful about when they are ready to put up that kind of cash for the next major investment in expanding production.” Schilling also discussed the need to strengthen partnerships. “Supplier-distributor-customer partnerships were strained over contract changes and pricing models. The US has always been and operated at the highest contractual standards. Our word is our bond, needs to be reaffirmed.”

Chris Wadsworth identified product sourcing and manufacturing capacity management as areas for improvement. “Single source products, many of which were older technology or legacy products, and the supply chain issues exposed the fragility of the supply chain as many of those products caused major disruptions and many long-lasting shutdowns of very critical industries. These disruptions cascaded through the commercial economy and had a lasting effect on companies and people inside and outside our industry. Capacity was also exposed on many critical commodity products that to this day have still not caught up to demand levels needed to support key technologies. We have leaned out much of the excess capacity and bringing on new capacity took much longer than experts expected, and capital equipment lead times went out exponentially as well during these last few years.”

Issues Looking Forward

Finally, these interviews presented an opportunity for executives to share what they believe will be the most important issues the electronics component industry will face this year. Chris Wadsworth turned his attention to “financial headwinds.” “The looming recession and inflation will affect growth and investment by our customers in the next twelve months. Interest rates continue to increase and at some point, will put more of a headwind on our industrial and electronics community. We have not had this level of inflation or interest rate environment and we must mitigate. The fact that SVB (Silicon Valley Bank) just went bankrupt, I feel will shoot challenges in many high-tech startups viability which exasperates the tech slow down and layoffs we have been seeing over the last quarter. This part of our industry ecosystem could experience additional head winds as a result. We are seeing fewer positive outlooks for a number of growth verticals over the last 3 months. Time will tell.”

In a final optimistic note Mike Slater expresses his view that, “getting balance into the industry in 2023 will be key. When I speak about balance, that is in many areas of the business. The increase in business in many areas brought about changes in the ways people worked. Customers were reacting to the increased demand and shortage of many materials and that caused people in various positions to focus on different things than they may have been hired for or wanted to do. It is similar for manufacturers and distributors I believe. With demand and inventory becoming more stable in 2023, we can focus on more of a regular rhythm of work. This still may look and feel different than it was three years ago, but we can chart out a more normal path now with what it will look like for the next 5-10 years.”

The Top 50 Americas Authorized Distributor Survey Results

Before presenting the results for 2022 it is important to highlight key areas of methodology followed in preparing this report.

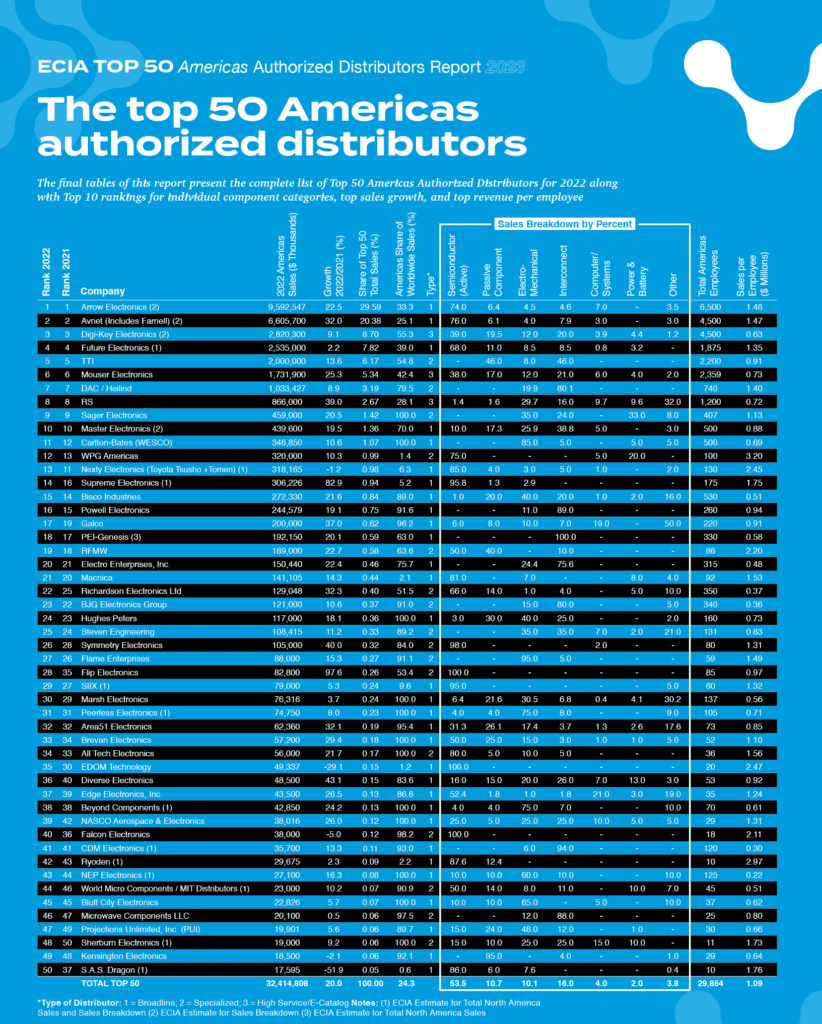

1. Only “Authorized Distributors” are included in the research and rankings. This is consistent with ECIA’s mission to support the Authorized Channel. As a result, brokers and others are no longer included and they have been replaced by authorized distributors in the Top 50 rankings.

2. The revenues reported for Arrow Electronics are limited to include only their revenues associated with electronic component distribution. For Arrow Electronics this corresponds to their “Electronic Components” division.

3. In some cases, companies have not provided inputs in all areas of the survey. Where companies did not provide inputs for worldwide or Americas total revenues, estimates have been developed based on inputs from various sources including D&B. Where splits for revenues by component category or end market were not provided, estimates were developed based on various inputs and models. The market share is an ongoing work in process as feedback enables refined estimates.

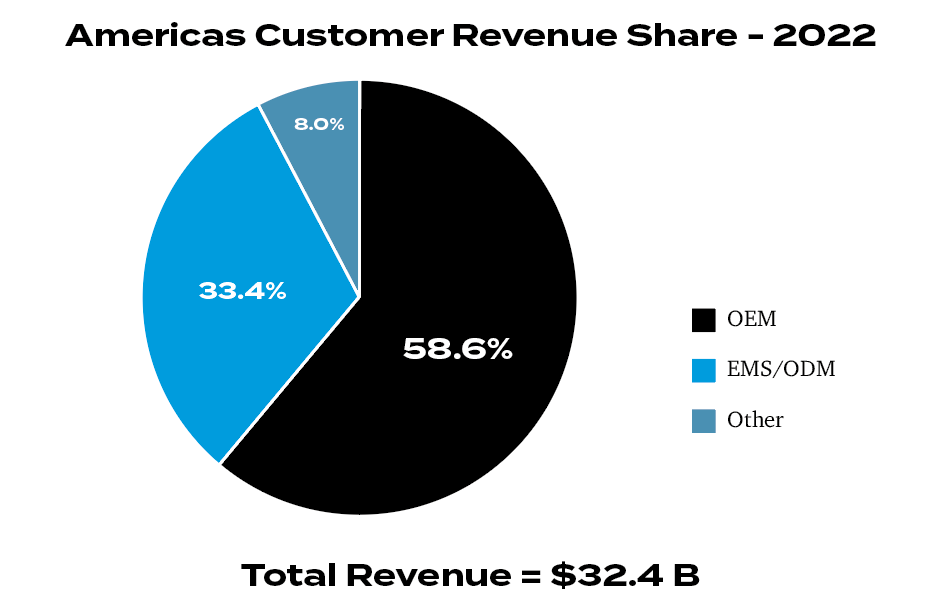

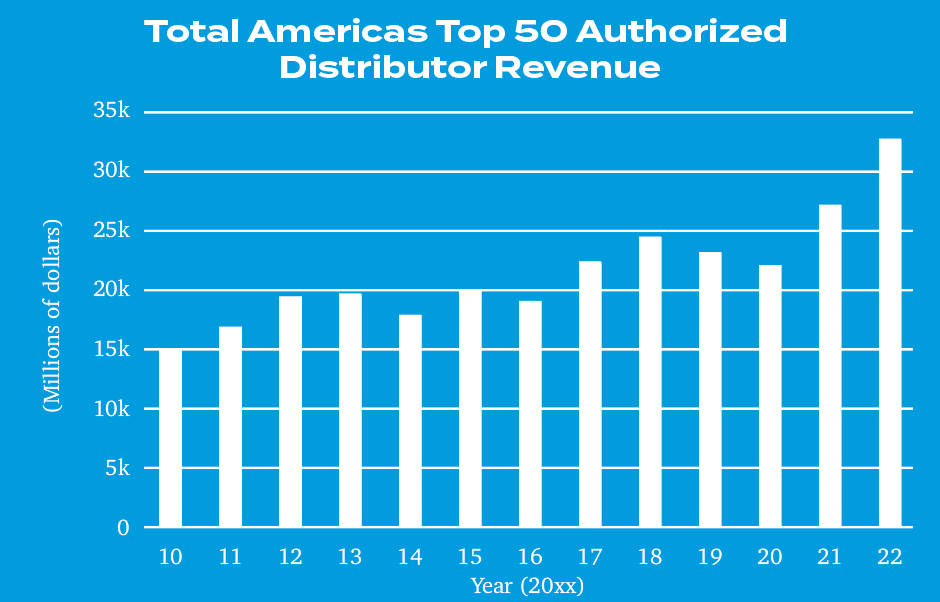

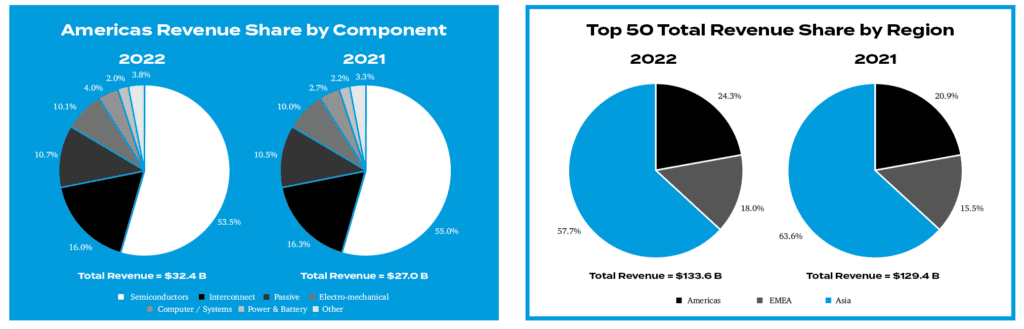

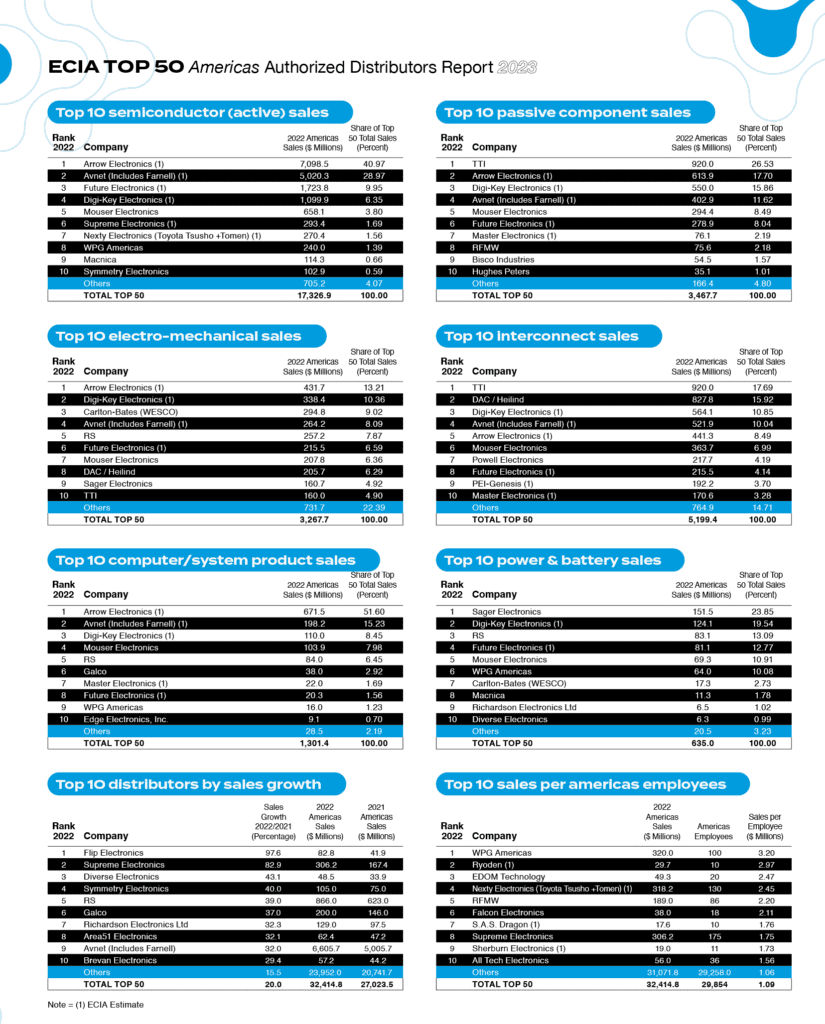

Total Americas revenue for the Top 50 authorized distributors in 2022 grew by 20% to $32.4 B from $27.0 B. This same group of Top 50 companies grew their combined worldwide revenue by only 3.3% from $129.4 B to $133.6B between 2021 and 2022, a growth of 3.3%. Worldwide revenues were depressed by a 6.3% decline in Asia sales. EMEA revenue growth almost matched the Americas growth as they increased by 19.9%. As a result, the Americas share of revenues jumped to 24.3% in 2022 and EMEA grew to 18.0% of worldwide revenues.

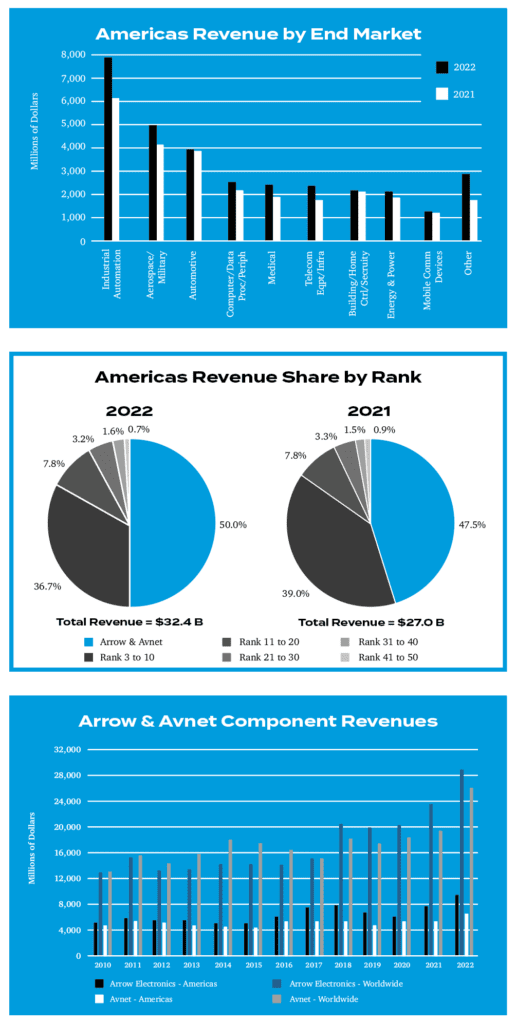

Americas revenues for the Top 50 distributors grew for every component category in 2022. Interestingly, the strongest revenue growth came in the Computer/Systems and Other categories. The relatively small size of these categories makes higher growth possible. Beyond these segments Passive Components achieved the highest growth in 2022 at 22.1% followed closely by Electro-Mechanical at 21.3% growth. The largest component category, semiconductors, saw its share of the total Americas market slip from 55.0% to 53.5%. Over the five-year period from 2017 to 2022 total Americas distribution revenue grew by 8.0% Compound Annual Growth Rate (CAGR) with Passive components leading the way followed by Electro-Mechanical components at 9.4% and 8.6% CAGR, respectively. Semiconductors grew by 7.4% CAGR and Interconnect components achieved 6.8% CAGR growth. Power & Battery was added as a separate category for the first time in 2021.

The top two North America Distributors, Arrow Electronics and Avnet, both saw a large boost in their Americas revenues in 2022. Arrow Electronics sales grew by 22.5% while Avnet’s growth came in at 31.9%. Avnet’s strong growth placed them in the Top 10 by sales growth in 2022. Avnet saw sales grow significantly higher than Arrow on the global stage. Avnet grew their worldwide revenue by 22.1% and Arrow Electronics by 9.2%. The Top 10 companies in 2022 with revenues of $28.1 B and a combined revenue share of 86.6% saw their revenues grow by 20.2%. By comparison, companies ranked between 11 and 50 with combined revenues of $4.30 B and combined market share of 13.4% saw their revenues grow by 18.3%. Average 2022 revenue for the Top 10 companies was $2.8 B while average revenue for companies ranked 11 through 50 was $108 M.

Once again, the largest end-market segments for Americas distributors in 2022 were Industrial Automation, Aerospace/Military, and Automotive, accounting for 21.0%, 14.0%, and 13.2% of the market, respectively. However, the market is fairly diversified with even the smallest segment, Mobile Communications, driving $1.3 B in revenues in 2022. OEMs continued to be the largest customers of distributors with 58.6% of total Americas revenue.