In this article, Dove Electronic Components explains how the crystal and oscillator market has been impacted by issues ranging from the pandemic to factory fires.

Dove Electronic Components has never seen anything like this market in its 38-years. As a pioneer of distribution-based sales of frequency control products, the company has seen a lot in its four decades in business. The closest comparable period was the hyped market 20-years ago during the dot.com bubble of 1999/2000. At that time the longest delivery was 32-weeks on products that were normally 10 to 12 weeks. This market is another animal entirely, with multiple factors converging to create disruptions and delays never before seen.

Deliveries are now quoted in months. In electronic component distribution we’re all accustomed to deliveries quoted in weeks. Crystal and oscillator devices, in normal conditions, would run from eight to 16-weeks with complex devices (often military or space) running 20 to 30-weeks. In this market 20-weeks is considered a good delivery that we encourage customers to jump on when we quote. We joke 20-weeks is the new four weeks and 32-weeks is the new eight to 12-weeks.

How did we get here? Obviously, the overwhelming global impact of Covid-19 provides the backdrop. We are mindful of those affected by Covid-19. We get information from suppliers, associations, publications and day-to-day dealings with customers. We feel the rollout of the China Tariffs in July 2018 was a starting point. It seemed this industry had just weeks’ notice to deal with this enormous logistical issue.

Suppliers shipping to the US felt pressure from customers to produce products anywhere but China. Moving production or selecting another supplier partner doesn’t happen overnight.

The widely used 32.768kHz tuning fork crystal is produced by a small number of volume manufacturers yet sold by probably hundreds of crystal and oscillator companies. This puts an enormous demand on the few manufacturers. One larger company exited the market, accounting for 20 per cent of production from reports we’ve heard. Remaining manufacturers had to pick up the slack. The 32.768kHz crystal was already on allocation in some cases well before Covid-19.

Rolling closures due to the pandemic started in March 2020. We did not know how the industry would react. We were pleasantly surprised with the initial uptick in business driven by medical electronics. Business has remained strong, but disruptions affecting lead-times are much worse. Pent-up demand for all product types has pushed the industry to the limit.

In late October 2020 there was a fire at Asahi Kasei Micro Devices (AKM) in Japan. The company manufactured circuits used in TCXOs. AKM supplied a huge percentage of the ICs used in this device, basically rendering it undeliverable. OEMs scrambled for other solutions and fought for remaining ICs. The fire contributed to panic buying across the industry whether the OEM used TCXOs or not.

Lastly, ongoing shortages of raw materials continue, including: crystal blanks, ceramic packaging, plastic packaging, IC substrates etc.

Solutions

At Dove Electronic Components we always want to offer our customer a solution for their needs.

As a Distributor we support our suppliers and always try to stick with who has the design & top spots on the AVL. We encourage customers to get their product on order no matter how long the lead-time may be. Once on order we’ll do what we can to get the product sooner for the customer. During that time we’ll try to offer solutions to get the customer through until they can get delivery. This can range from accepting a tolerance that is not as tight or a narrower temperature range and other the concessions the customer may be able to make. Dove’s extensive line card of Authorized Crystals & Oscillator Suppliers has really been worked during this time. As a company we do not condone double ordering and we feel customers would be better served to accept additional product as no one knows when this market will return to more normal delivery cycles. Product costs have increased up 25% to 40% in some cases, a few devices have no resemblance to their former pricing. Dove does the best it can with keeping pricing as competitive as possible when passing along these increases.

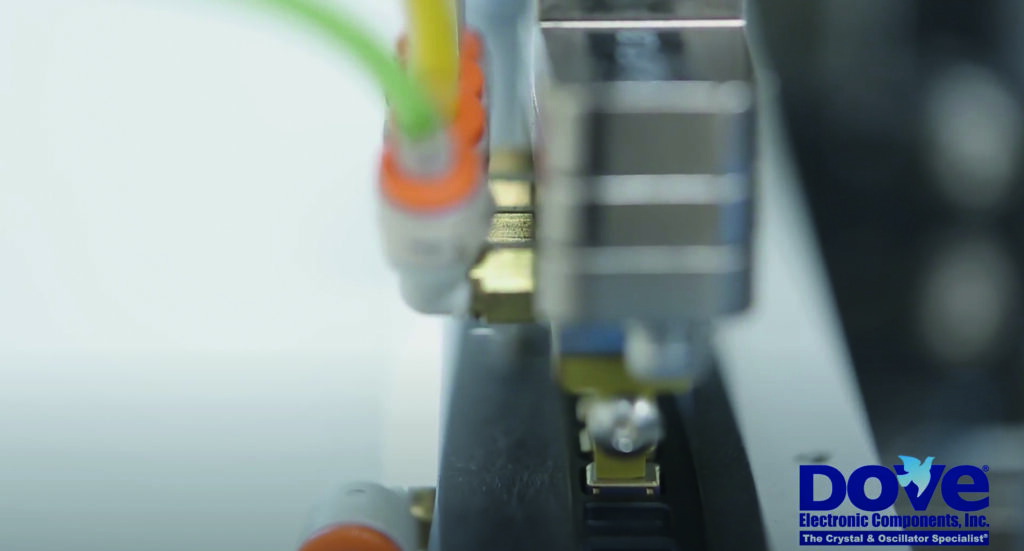

Programmable Oscillators

Dove’s in house oscillator programming center has been invaluable during this time. We can configure the package and the frequency a customer needs and ship the same day if we have the un-programmed oscillator blank in stock. The programmable oscillator still remains a great option.