Avnet’s sales director lighting and transportation, Jason Skoczen, explores the infrastructure required to charge millions of vehicles at home and in public.

As a global organization, Avnet has a privileged insight into how the EV charging infrastructure is developing across the world. Governments and private companies are generating growing momentum behind the move to fully battery-electric vehicles (BEVs). However, not all regions are developing infrastructure at the same rate.

The dynamics of refueling internal combustion engine vehicles are fundamentally different from supplying electricity for BEVs. At minimum, public charge points will be installed alongside fuel pumps. However, the obvious difference is the refuel v recharge timeframe. This creates demand for more charge points at more than just service stations.

Avnet Silica systems engineer working across EMEA, Harvey Wilson, said: “The UK government recently announced an extra £1.6 billion to extend the EV charging infrastructure. This will see the number of charge points reach 300,000 by 2030, which will be five times more than the number of fuel pumps in the UK.”

According to Statista data, China currently has a higher number of fast and slow charge points than any other region. Avnet’s sales director for China, Tom Wang, has seen rapid growth in the number of charge points, with around 50 per cent annual increase over the last three years. He said: “The charging infrastructure has been extended to all corners of the country, even in the remote countryside. The vehicle-to-charge point ratio in China is around 3:1.”

Although the typical electric vehicle is a family car, bus or delivery truck, in India the vehicles of choice are more for personal mobility, with two or three wheels. This is where the move toward electrification can most be felt today. Consequently, the charging market is focused on ACDC chargers for smaller personal vehicles. According to Avnet’s associate director of supplier product marketing and field application engineering Asia, Sambit Sengupta, some momentum exists behind the concept of a battery-as-a-service model for this class of last-mile vehicle.

In North America the picture is, slightly different. Avnet America’s director of business development managers, Jason Skoczen, reported demand increase for charging stations that support a wider range of e-vehicles including fleet vehicles, motorcycles and even commercial, construction and agricultural vehicles (CAV).

The European Union’s Fit for 55 target will need at least 60 per cent of all road vehicles to be either fully or partially electric by 2030. Avnet Silica’s director of vertical markets, Thomas Foj, predicts this will require at least six million new charge points by that time. Germany aims to have one million charge points by 2030, compared to just 50,000 today.

Avnet Abacus’ sales director for central Europe, Tobias Nakel, reports activity in the market coming from several angles, saying: “We do see that the big Tier 1 automotive electronics manufacturers are heavily engaged in this field, as well as multinational industrial companies.” He also reports fragmentation, with a lot of mid-sized companies bringing new and innovative designs to market.

While the number of charge points must increase, variety must also be addressed. Fast DC chargers are nice for car drivers but could be essential for freight and mass transport vehicles.

Fast DC chargers require DCDC converters which can operate continuously at higher voltages. Partial discharge immunity will also be important when switching high voltages. This relates to the gate drivers but the isolation barrier is a known weak point in high-voltage circuits. Similarly, DCDC converters should have a low isolation capacitance, lower than engineers might otherwise specify. The physical distance between the SiC or IGBT, gate driver and converter will also be an important design consideration.

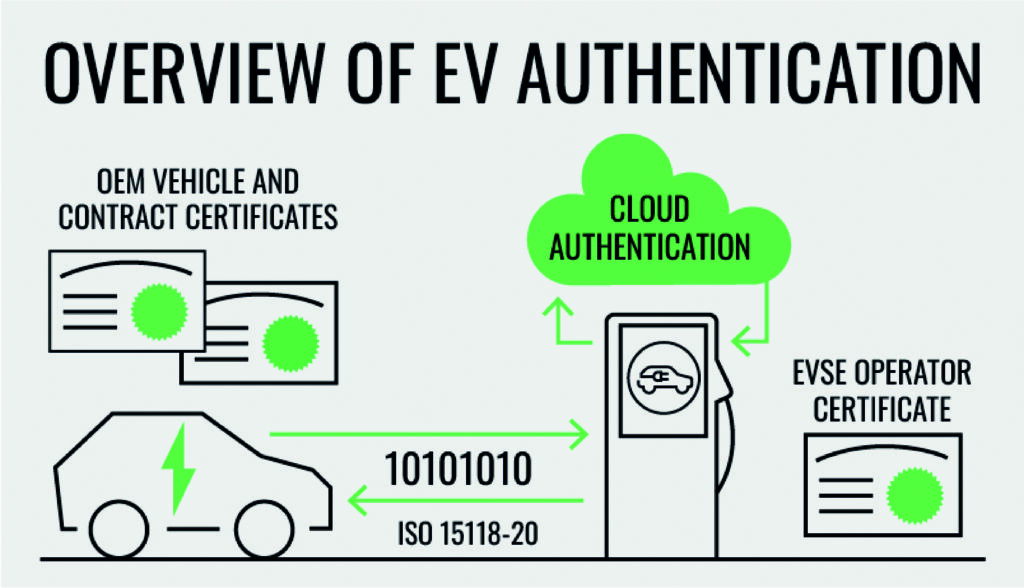

Security is another requirement, addressed by specifications such as ISO15118:20. They need to be studied closely and implemented correctly. The latest edition supports multiple contracts and improves the overall levels of security imposed.

Other considerations include choosing the right output power level for each market. For example, not all EVs can plug directly into a DC supply. Charge point operators must understand the demand at any given public site and work with electric vehicle supply equipment manufacturers to install the right solutions.

Most installations will feature multiple charge points so the load balancing is required, involving controlling and, if necessary, limiting the power delivered to specific charge points connected locally. If this isn’t implemented, grid surges would quickly become unsustainable.

Momentum behind EV charging growth is creating new opportunities. Avnet Embedded, which works with OEMs to deliver turnkey solutions, has seen a massive increase in the number of electric vehicle supply equipment manufacturers in the last two years and expects this growth to continue for several more years.