Capacity challenges persist

Thomas Smart discovers the biggest challenges facing independent distributors are inflation, lead times and component shortages.

Continued financial instability has been a major challenge recently faced by the electronic component industry. The pandemic-induced global economic downturn has resulted in supply chain disruptions and reduced supply, plus inflation which increased significantly late 2022 and early 2023. Inflationary pressures have created additional challenges for independent distributors, as they work to maintain profitability while dealing with increased operating and inventory costs. Raw materials prices, transportation costs and other expenses have increased significantly, further exacerbating the situation. Despite these challenges, the industry remains optimistic, with many distributors focusing on building stronger relationships with customers and suppliers to weather the storm.

American Sun Components explained how it shields customers from inflation:

“We have a just-in-time inventory model wherein we secure the stock in order to ship it to the customer immediately. We also have legal devices/contracts in place which keep the prices stable for us and therefore our customers.”

Utilizing excess stock can also reduce the impact as Perfect Parts explained: “Perfect Parts helps to mitigate the risk of rising inflation and its direct effect on customers by utilizing our client’s excess inventory to offset costs both on and off the board.”

Another concern for independent distributors is manufacturer production capacity limitations which directly affect component lead times and the likelihood of shortages. Component manufacturers’ production capacity has been hit by a range of factors including supply chain disruptions, factory shutdowns and a lack of investment in new production facilities.

The pandemic had a significant impact, with many manufacturers forced to shut their production facilities to comply with lockdown regulations. It also resulted in supply chain disruptions, leading to delays in the delivery of raw materials.

Smith’s president—Americas, Todd Burke, explained: “Production capacity has started to stabilize but is still below pre-pandemic levels. Production capacity at foundries and IDMs has returned to normal and, in some cases, has been reduced to levels lower than what they were before the pandemic. That said, however, many of the backlogs that were created during the capacity decreases still exist. Specifically, automotive and industrial chips will continue to have supply constraints throughout 2023 and into 2024 while awaiting capacity expansions to come online.”

Perfect Parts concluded: “Although capacity is increasing it is nowhere near normal levels and part shortages will continue posing a challenge for manufacturing in the foreseeable future.”

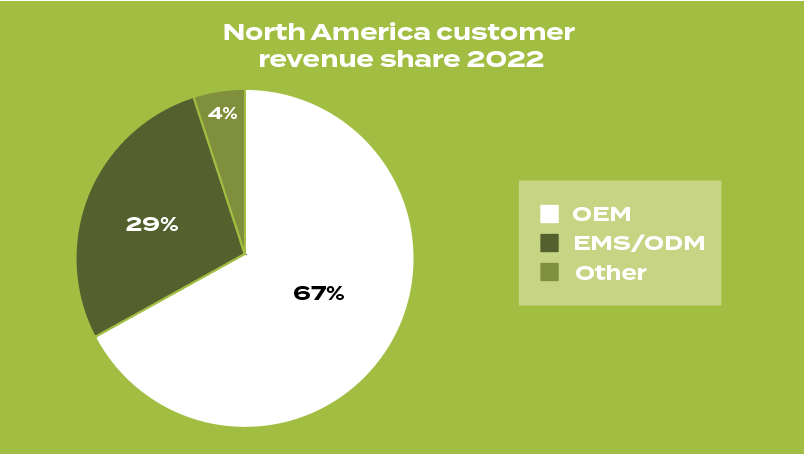

Automotive components dominate independent NA revenue share

In 2022 the independent North American electronic component industry was dominated by automotive related components comprising of nearly a third of market share at 32.4 per cent, followed by computer/data processing/peripherals at 13 per cent, aerospace/military at 11.2 per cent and industrial automation rounding out the top four with 10.2 per cent.

Distributors have highlighted the key factors behind the high demand for automotive components as a large increase in the number of manufactured electric vehicles (EVs) and hybrid electric vehicles (HEVs), including charging points and accessories, plus an increase in smart technology within traditional internal combustion vehicles such as multimedia displays, inbuilt GPS, lane detection sensors and surround cameras.

Automotive key independent sales driver for next five years

Automotive related components are expected to remain a key sales growth driver for the next five years for independent distributors. The automotive industry has been rapidly evolving with the integration of electronic components in vehicles, with this trend expected to continue. Use of electronic components in vehicles has increased significantly, creating new opportunities for independent distributors.

Moreover, increasing demand for electric vehicles is driving growth in the automotive industry. Electric vehicles require significant amounts of electronic components, including batteries, semiconductors and charging infrastructure. This increases demand for independent distributors to supply these components to electric vehicle manufacturers.

Growing demand for AI is another sales growth driver for the next five years. Significant investment in research and development is expected to push demand for components including processors, sensors and memory devices that are designed to handle the amounts of data AI applications generate. Thus, OEMs and contract manufacturers are increasingly sourcing these types of electronic components.

Another driver is IoT which has enabled the development of smart homes, industrial automation systems, wearable health devices and intelligent transportation systems. In smart homes, IoT devices let homeowners control various household appliances and systems remotely.

Industrial automation systems use IoT technology to optimize processes and increase efficiency. Wearable health devices, such as fitness trackers, monitor various health metrics, including heart rate and sleep patterns. Intelligent transportation systems utilize IoT technology to improve traffic flow and safety. All these applications are driving component demand, especially for sensors.