In this article, IPC presents statistics and thoughts on subjects including manufacturing services, Government support for supply chains and electronics sector sentiment

In this article, IPC presents statistics and thoughts on subjects including manufacturing services, Government support for supply chains and electronics sector sentiment

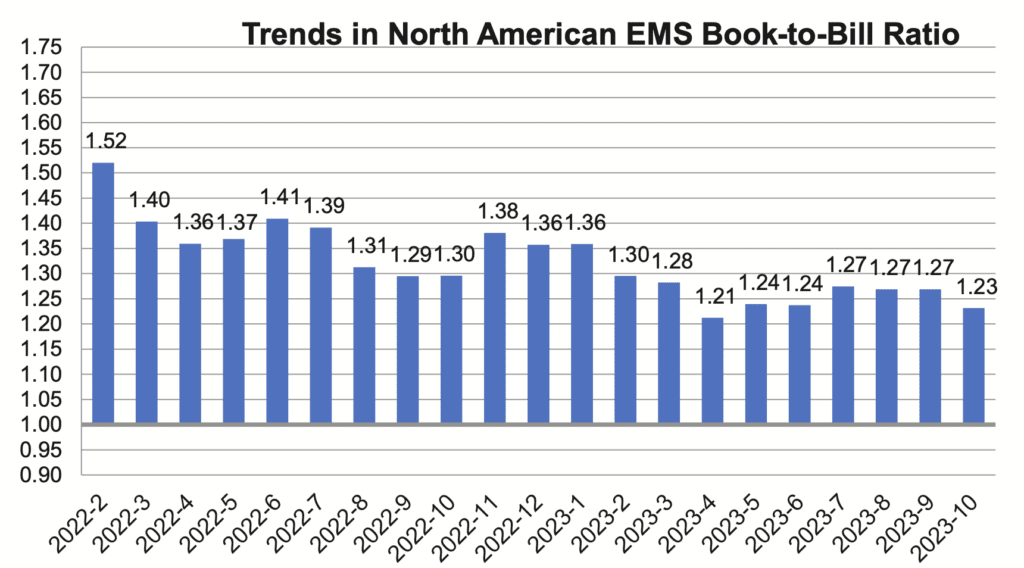

IPC has announced the October 2023 findings from its North American Electronics Manufacturing Services Statistical Program. Book- to-bill ratio stands at 1.23.

Total North American EMS shipments in October 2023 were down 7.4 per cent compared to the same month last year. Compared to the preceding month, October shipments decreased 0.5 per cent. EMS bookings in October decreased 19.5 per cent year-over-year and decreased 4.8 per cent from the previous month.

IPC’s chief economist, Shawn DuBravac, said: “EMS bookings were weak for the second consecutive month. The year-to-date trend for bookings declined to its lowest level of the year.”

Strengthening supply chains

In other news, IPC welcomes the actions outlined by the US Government ‘to strengthen supply chains critical to America’s economic and national security’. Covid-era disruptions experienced by the US electronics manufacturing industry spotlight the extent to which the United States has outsourced its industrial base impacting everything from automobiles to aircraft to consumer products.

Investments being made under the CHIPS and Science Act, Defense Production Act and Inflation Reduction Act must cover more than just a few key products such as semiconductors—they also need to include the full electronics manufacturing system that enables semiconductor chips to function including printed circuit boards and integrated circuits substrates.

IPC is pleased to see actions complementing prior announcement of a National Advancing Packaging Strategy. In addition, IPC welcomes the creation of a Cabinet-level Council on Supply Chain Resilience and a new quadrennial review process to ensure a comprehensive approach to this vital issue. IPC applauds the actions to solidify the US defense industrial base and the emphasis on international cooperation.

Materials costs improve

Finally, IPC has released its November Global Sentiment of the Electronics Supply Chain Report. Sentiment improved during November with demand sentiment also taking a solid step up over the last 30 days. Although materials costs continue to improve, labor costs remain a pain point. Some 62 per cent of electronics manufacturers say they are currently experiencing rising labor costs. Shawn DuBravac continued: “In this month’s survey, we asked a special question about PCB and EMS production growth. Electronics manufacturers believe the US should adopt strong goals for production growth.”

For the PCB sector, roughly 85 per cent of respondents reported the five-year goal should be above current levels and the average suggested goal was 9.3 per cent of global production. For the EMS sector, roughly 70 per cent of respondents indicated a five-year goal above current levels. On average, respondents indicated the EMS industry should target 12.9 per cent of global production by 2028 and 17.4 per cent of production by 2033.

Additional survey data show: the New Order Index rose five points to 105 after hitting the lowest level for this index; the Materials Cost Index fell to another new low, dropping four points to 118; the Labor Costs Index rose one point to 130 after declining for

two consecutive months; and shipments, orders, capacity utilization, backlogs and profit margins are expected to rise over the next six months, while all other key business indicators are expected to remain relatively stable.