As the EV market emerges from major supply chain disruptions, demand is strong for power components and microcontrollers/ microprocessors. However, some shortages loom

Analysts are optimistic that 2023 will wrap as a growth year for the EV industry. Demand for two major component families, power and MCUs/MPUs, is on the rise.

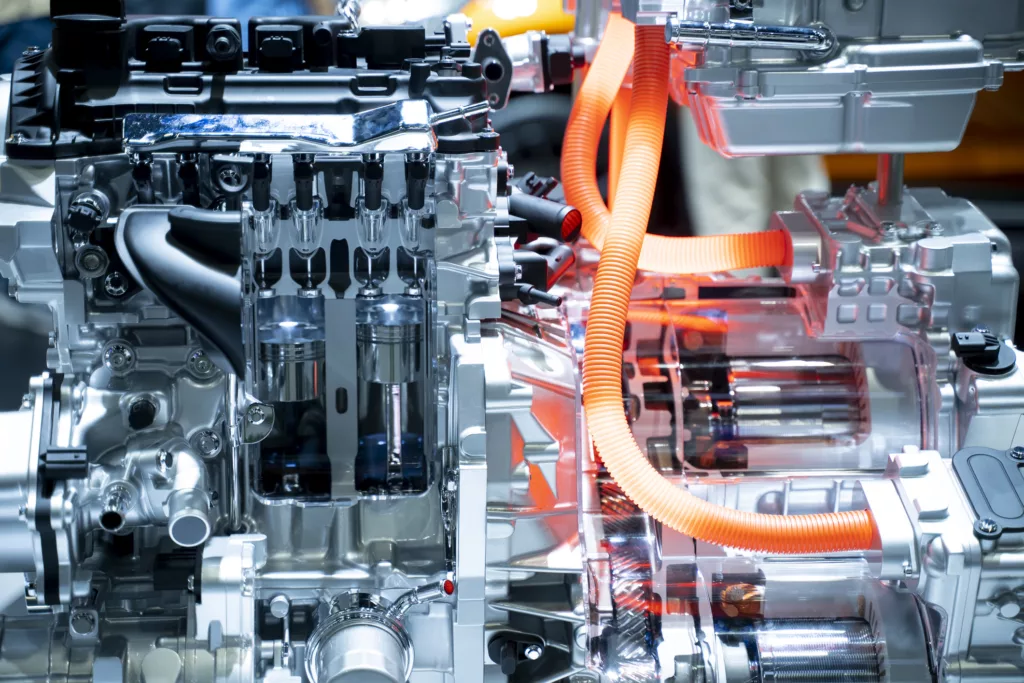

Power electronic components play a key role in converting the battery’s DC voltage into the AC voltage necessary to drive the electric motor. These inverters, together with AC/DC converters for onboard charging and various DC/ DC converters, rely on power semiconductors.

Examples are IGBTs, silicon power transistors, MOSFETs and SiC/GaN power devices. All have been in short supply since 2020 and remain the most constrained in the power stage portfolio. Many chip makers have announced plans to expand production and are looking to make long-term deals with ecosystem partners. For OEMs, distributors can be critical partners in helping navigate this shortage.

There is also a growing need for passive components and interconnect that can withstand the high voltages and power that need to be specially modified for EV power trains.

Considered the heart of an EV, the battery pack comprises numerous lithium-ion battery cells. Lithium is quite a rare element, although not technically a ‘rare earth metal’ as it is sometimes described. It’s the most significant element in most rechargeable batteries, whether they’re used in EVs or smartphones.

According to commodities price reporting agency Fastmarkets, EVs are likely to account for 73 per cent of all lithium demand. The firm expects 28 per cent year-on-year demand growth for lithium in 2023 and a further 24 per cent growth in 2024.

According to the US Geological Survey, Nevada is the only state to extract lithium and the US has access to just 3.6 per

cent of global reserves. China has a lot more and analyst Wood Mackenzie estimates the country has 75 per cent of the world’s lithium-ion battery manufacturing capacity. Argentina, Australia and Chile also have large lithium reserves.

Boston Consulting Group forecasts a lithium supply shortfall by 2030 and warns companies across the battery value chain must mobilize now to boost supplies and diversify their supply chains. In the short term, there seems to be plenty of lithium. Its price dropped dramatically earlier this year, but the EV industry and OEMs need to plan for longer- term potential shortages.

MCUs are ubiquitous in today’s cars. More than 50 can be found in high-end models. They’re used in infotainment

and control systems with applications encompassing touchscreens, navigation systems, climate control, connectivity features

and advanced driver assistance systems.

In EVs, MCUs are also used in monitoring and managing the battery pack via the battery management system. This continuously monitors individual battery cells within the pack, ensuring their optimal performance, balancing their charge levels and safeguarding their overall health and longevity. They’re also central to the vehicle’s thermal management systems which regulate the temperatures of critical components such as the battery, power electronics and electric motor. They incorporate cooling fans, radiators and liquid-cooling systems to maintain ideal operating conditions.

Although the supply chains for automotive MCUs have been stabilizing, rapid growth in EV sales led to some shortages, particularly for high-end 32-bit MCUs. Compared with 8-bit and 16-bit parts, 32-bit MCUs are the dominant type in automotive applications. As higher-performance parts, 32-bit MCUs tend to be manufactured using more advanced process nodes, sometimes down to 22nm. This limits the choice of foundries for MCU makers and represents an additional supply chain risk.

Estimates say TSMC makes approximately 70 per cent of MCUs used in automotive applications. Based in Taiwan, the company also has wholly owned subsidiaries in the US, Japan and China. It has invested some $40 million in US fabs over the past two years, in part to mitigate its own geo-political risks.

Research And Markets points to one factor that may curb future demand for discrete automotive MCUs. There’s a tendency to move toward more centralized controller architectures that use high- performance systems- on-chip (SoCs) to tackle increased functional complexity. Many MCU functions may be implemented within these SoCs, which will also feature new memory architectures and growing AI capabilities. While MCU vendors seek to differentiate their products, OEMs are establishing closer ties with them to drive chip standardization and greater supply chain security.

EV component supply chains have improved significantly in the last year, and it looks like the trend will continue at least through 2024. Shortages loom for wide-bandgap power components and 32-bit MCUs. Predicting further out is tough, but an understanding of industry structures for both components and the raw materials can help component buyers navigate a path forward. Ecosystem partnership will become more critical as companies endeavour to meet market demand.