ECIA’s Electronic Component Sales Trend (ECST) February 2024 Survey Results.

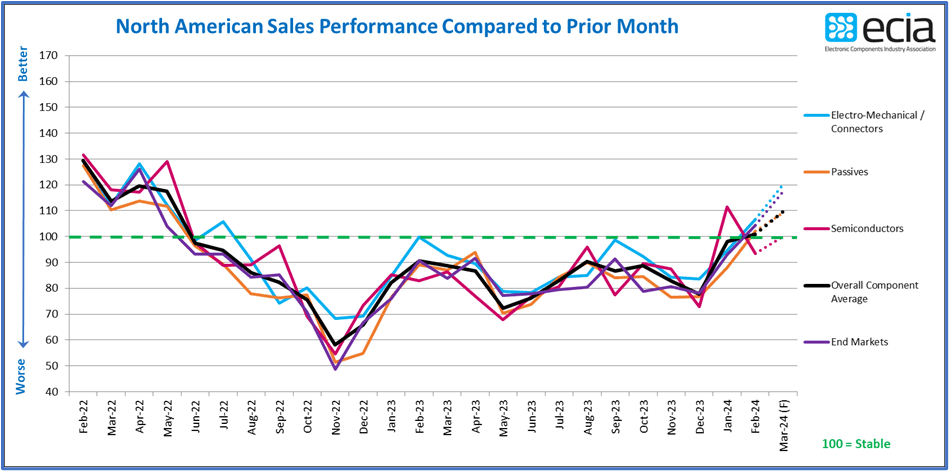

Driven by strong improvements in the index scores for Passive Components and Electro-Mechanical/Connector Components the overall ECST index moved into positive sales sentiment territory with a score of 100.8.

“It has been 21 months since the overall sales sentiment index topped 100,” explained Dale Ford, ECIA’s Chief Analyst. “The index languished at an average of 85.2 for the prior year, unable to sustain any meaningful improvement until a positive surge to begin 2024 started in January. This momentum carried over into February with the encouraging outcome of an overall positive sentiment score. The positive momentum is projected to carry into March with a projected improvement of 9 points in the overall average to nearly reach 110 points.

“The longer-term outlook presented by the Q1 2024 ECST survey delivers more positive news for the electronic components industry,” Ford continued. “In Q1 2024 the overall net index score delivers a positive 1% outcome. The best part of the quarterly survey is the outlook for Q2 2024, as positive energy sweeps across the market and delivers a net positive score of 33%.”

For the complete summary report, click here. Members can view the full reports here.

The ECST survey provides highly valuable and detailed visibility on industry expectations in the near-term through the monthly and quarterly surveys. This “immediate” perspective is helpful to participants up and down the electronics components supply chain. In the long-term, ECIA shares in the optimism for the future as the continued introduction and market adoption of exciting innovative technologies should motivate both corporate and consumer demand for next-generation products over the long term.

The complete ECIA Electronic Component Sales Trends (ECST) Report is delivered to all ECIA members as well as others who participate in the survey. All participants in the electronics component supply chain are invited and encouraged to participate in the report so they can see the highly valuable insights provided by the ECST report. The return on a small investment of time is enormous!

The monthly and quarterly ECST reports present data in detailed tables and figures with multiple perspectives and covering current sales expectations, sales outlook, product cancellations, product decommits and product lead times. The data is presented at a detailed level for six major electronic component categories, six semiconductor subcategories and eight end markets. Also, survey results are segmented by aggregated responses from manufacturers, distributors, and manufacturer representatives.

Non-members can now purchase the ECST report at https://www.ecianow.org/purchase-reports.